UK Coalition Agreement

Agreed programmes for government are common in Europe but a novelty in British politics. This 36-page final agreement between the Tories and Lib Dems will have a major bearing on how Northern Ireland’s services are funded and taxes are raised. Furthermore, it explains the broad Conservative-Liberal Democrat approach to running the UK as a whole and suggests where tensions could arise.

Economy

Cutting the deficit “takes precedence over any of the other measures in this agreement” and the speed of any new spending programmes will depend on the new Comprehensive Spending Review (CSR), reporting in the autumn.

An accelerated reduction in the structural deficit, mostly by spending cuts rather than tax rises, must be achieved over the parliament. Revised forecasts for borrowing and growth will be made before the 50-day budget by the new, independent Office for Budget Responsibility.

Reducing headline corporation tax is a priority. The commitment to a government paper on varying Northern Ireland’s rate is carried through.

£6 billion cuts in non-frontline services are proposed for 2010-2011, although the final figure depends on Treasury and Bank of England advice.

Increased year-on-year spending for the NHS can only be guaranteed in England, as health is devolved, but this could result in a Barnett consequential i.e. extra spending which the Northern Ireland Executive would be free to spend on health if it wishes.

The link between earnings and the basic state pension would be restored from April 2011. This includes the Lib Dem proposal to raise pensions by the higher of three percentage rates: growth in earnings, growth in prices or 2.5 per cent.

Exact numbers will be announced in the budget. Personal income tax allowances will go up for lower or middle income earners from April 2011. Employers would pay less national insurance – to stop Labour’s ‘jobs tax’ – but employees would pay more.

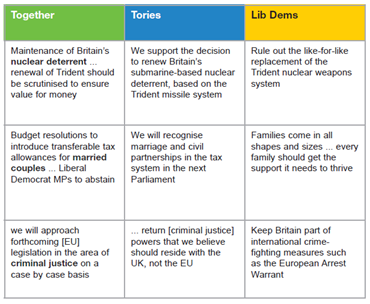

Increasing the basic personal allowance to £10,000 from the current £6,475 is a long-term aim. Cutting inheritance tax is no longer a high priority. Transferable tax allowances, to benefit married couples and civil partners, will be introduced by the Tories but Liberal Democrats can abstain.

A Lib Dem crackdown on tax avoidance will also go ahead, with strengthened powers for HMRC. White collar crime will be tackled by a new single agency. The goal to end child poverty by 2020 is kept on.

A banking levy will be introduced with “robust action” also taken against “unacceptable bonuses”. The sector must become more competitive and diverse with more promotion for mutuals.

The coalition would also consider a major loan guarantee scheme and net lending targets for nationalised banks. Labour’s last budget, though, announced that these banks had agreed legally binding lending commitments for the 12 months from March 2010.

An independent commission will look at how to separate retail and investment banking. The Bank of England will control ‘macro-prudential’ regulation i.e. the overall system’s stability and oversee the ‘micro-prudential’ regulation of individual instructions.

A free national financial advice service, previously suggested by Labour, will be fully funded by a social responsibility levy on banks. Private capital is to be injected into Royal Mail but the Post Office would remain publicly-owned, and provide a wider range of services.

Reform

“We will work to bring Northern Ireland back into the mainstream of UK politics,” the coalition states, following on from the UCUNF project. The UK Government will stand firm behind all the negotiated agreements and their institutions.

Fixed term parliaments were suggested, with the next poll to be held on 7 May 2015. The margin for no confidence vote could be raised from 50 to 55 per cent and a recall power is proposed, forcing a by-election if an MP is found guilty of serious wrongdoing.

The parties both back a referendum on electoral reform, although they will take differing sides. Parliament’s select committees will have more power to scrutinise major public appointments. Primaries will be held in 200 safe seats, with campaign funding for all parties with sitting MPs. Petitions with 100,000 signatures could be considered for parliamentary debate.

All of these proposals will need MPs’ approval and some backbenchers are already uneasy e.g. pointing out that fixed terms could keep an unpopular government going ‘to the bitter end’.

Two new commissions will be established: one to propose “a wholly or mainly elected upper chamber” using PR, and the other to reconsider the West Lothian question. The first reports by December 2010 while the second has no timescale as yet.

Security

A strategic defence and security review has been commissioned by the new National Security Council. Trident stays but its renewal will be scrutinised for value for money. The military covenant is to be “rebuilt” with maximised rest and recuperation for troops.

An annual immigration cap on non-EU working migrants is to be imposed, enforced by the dedicated border police force. This will report to the Serious Organised Crime Agency and work with the PSNI and other local forces. Eborders and exit checks are supported. Detention of child immigrants will end.

Groups which have “recently espoused or incited violence or hatred” are to be denied public funding, and could be proscribed on police and intelligence service advice.

Reflecting Tory thinking, no further powers shall be transferred to the EU in this parliament; any future transfers will go to a referendum. “State intrusion” is to be rolled back. This includes scrapping ID cards and extending the Freedom of Information Act’s scope. A commission will consider a British bill of rights.

Some proposals are likely to be introduced to Northern Ireland by parity legislation. State pensions will only be granted after 66 years, but this will not happen before 2016 for men and 2020 for women. The default retirement age will also be phased out. Benefits for those able to work will be conditional on willingness to work.

Devolution watchers should study Scotland, where the Calman Commission’s plans will be implemented. Crucially, this means giving the Scots the power to set their own income tax rates with the remaining block grant “justified by need”. A similar commission is expected in Wales if the Welsh vote for extra powers. England’s 12 largest cities will elect their own mayors, thus giving them more influence as well. The Barnett formula therefore looks likely to end and Northern Ireland will have to compete with more voices at the financial table.

Northern Ireland MPs’ influence is currently limited due to the coalition’s 41-seat majority, although they could have a greater say in the free votes on political reform or where the Liberal Democrats abstain. The Executive is also free to ‘borrow’ ideas from the coalition but, in a rather circular way, that freedom also depends on finance from an increasingly tightened Treasury.