Tourism performance: Opportunity and challenge

A record-breaking year for tourism in Northern Ireland has put the sector on course to meet its target of being a £1 billion industry by 2020 a year early, however, significant challenges remain if the ambition to double this figure by 2030 is to be achieved.

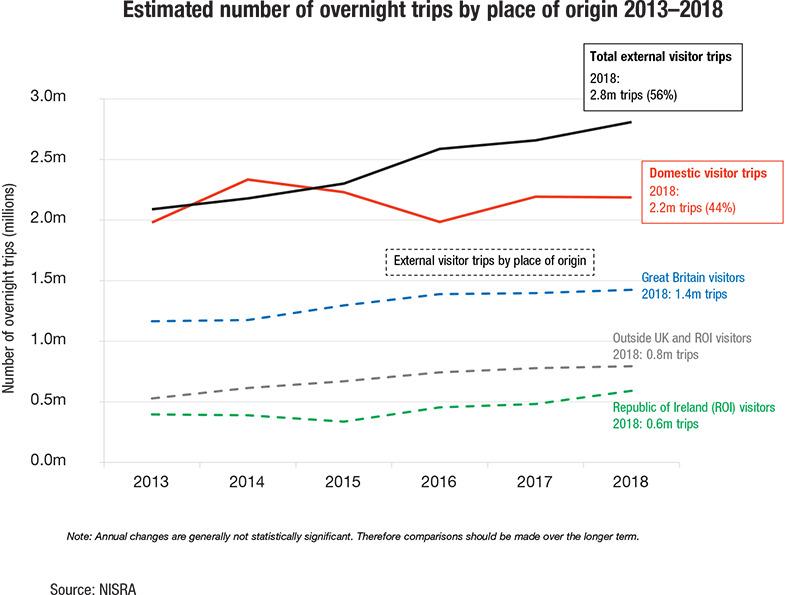

Northern Ireland reached a milestone in 2018 when the number of visiting tourists eclipsed the level of domestic tourism for the first time. ‘Proper’ tourism has emerged on the back of year-on-year growth for the sector in recent years, now gaining recognition as a key economic driver for Northern Ireland as a whole.

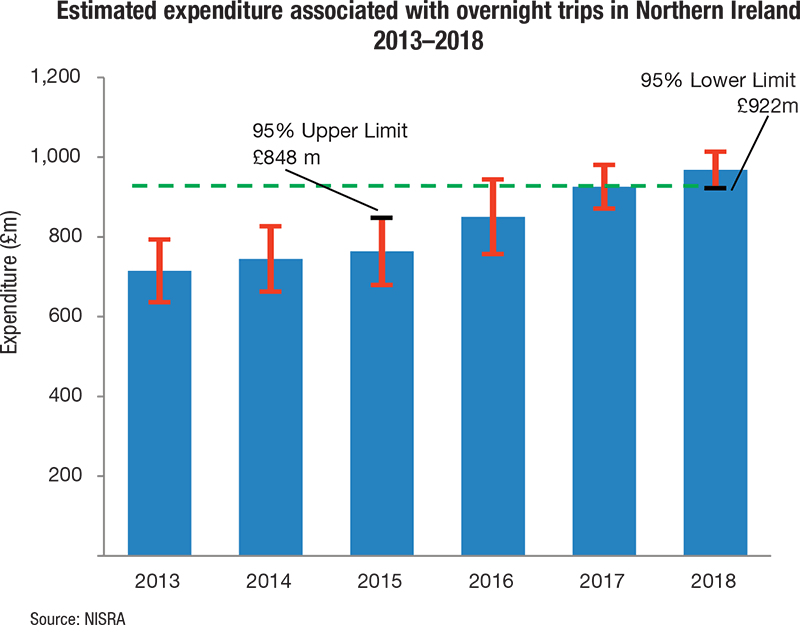

Official figures for 2018 show that the overall tourism spend of £968 million falls just short of the £1 billion target set for 2020. The figure is an increase of £42 million on the previous year and with recent events such as The Open 2019 being recognised as an economic success, the £1 billion target will likely be surpassed in 2019.

Of the five million visitors to Northern Ireland in 2018, a record-high of 2.8 million were overnight visitors from outside of Northern Ireland. This growth was largely attributed to the Republic of Ireland market, where a 23 per cent increase can largely be attributed to a decrease in sterling and representing a strong exchange rate for the euro. However, trips from GB and other overseas countries were also up by 2 per cent.

Increased visitors in Northern Ireland also spent more in 2018. An average of £2.7 million was spent every day in Northern Ireland compared to £2.5 million in 2017. Expenditure associated with non-domestic tourist trips was 69 per cent (£669 million) of the total spend.

Not all the figures within the record breaking year were positive. The 16 million bednights in 2018 were a 3 per cent decrease on the previous year and steep declines for international markets and a flat GB market were somewhat masked by a 44 per cent increase in nights from Republic of Ireland visitors.

The amount of trips attributed to holidays were also down slightly, driven by fewer domestic visitors holidaying at home. However, ROI and GB trips grew by a combined 7 per cent, while other overseas holiday trips grew by 12 per cent. Good growth was recorded for business trips and trips to visit friends/families.

Hotels recorded a record breaking year, aided by a large increase in the number of beds/hotels new to the market. Hotel occupancy was estimated to be 70 per cent, with 2.2 million hotel room nights sold in Northern Ireland, up from 2.11 million in 2017.

A total of 128 cruise ships docked in Northern Ireland ports in 2018, carrying 203,000 passengers and crew. These figures have steadily increased year on year and are significantly higher than the earliest record of 2013 when 62 cruise ships docked carrying 103,000 people. Of the ships docked in 2018, 118 were in Belfast, eight in Derry and two in other ports.

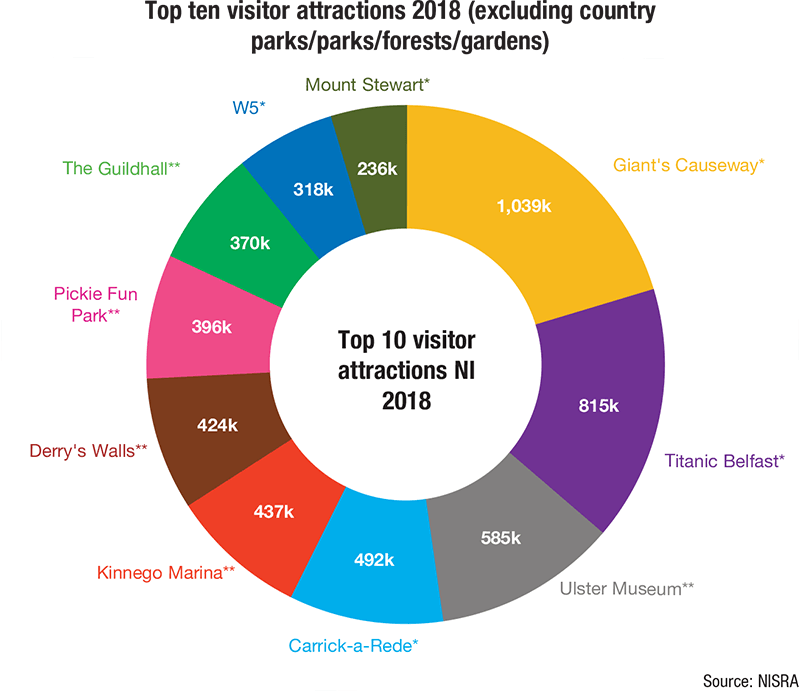

The top three visitor attractions in Northern Ireland, excluding parks and gardens, during 2018 were the Giant’s Causeway, Titanic Belfast and the Ulster Museum. Northern Ireland’s main attractors, Titanic Belfast and the Giant’s Causeway, recognised a 5 per cent increase over the year.

Opportunity

Undoubtedly, Northern Ireland is on a positive trajectory in regards to tourism performance and awareness is growing around its importance in growing the overall Northern Ireland economy.

Strong 2018 performance is likely to be surpassed in 2019 and Northern Ireland has continued to develop its offering to attract major events. Nearly 240,000 people visiting Portrush earlier this year for The Open 2019, an estimated economic uplift of between £80–100 million, is a prime example of Northern Ireland’s growing attractiveness.

Work is already underway to bring the event back in the coming years and discussions are ongoing to bring the FIA World Rally Championship to Northern Ireland in 2020. As well, as event tourism, Northern Ireland continues to build on its reputation for business tourism, aided by the multi-million pound development of the ICC (International Convention Centre) Belfast.

Recognition exists of a changing global tourism marketplace and the need to equip Northern Ireland to meet changing demands. Creating experience packages and joining up the tourism offering has been identified as a major opportunity to enhance the attractiveness of Northern Ireland to non-domestic visitors. At the same time the evolution of digital technology presents major opportunities for Northern Ireland, not only to enhance its current offering but also to gather better quality data on visitors, allowing for a more tailored experience.

The absence of an approved tourism strategy has been identified as a major challenge in driving future tourism growth. A draft strategy, created in 2017, still awaits political sign off and the absence of policy direction and subsequent long-term funding is potentially detrimental to one of Northern Ireland’s key growth sectors. However, in a sector recognised for its resilience, work is progressing, where possible.

Progress is set to be aided by two major policy initiatives. The Belfast City Region Deal, with an anticipated total investment of over £1 billion, has identified tourism and regeneration as one of four key investment pillars, including infrastructure; innovation and digital; and employability and skills.

The deal identifies the opportunity for a step change in the tourism offering, delivering a series of internationally visible tourism products that “will extend the tourist route from Belfast through Carrickfergus, towards the Causeway Coast and Glens along Ards and North Down and into the Mourne Mountains”.

Projects included in the deal include:

- a Belfast Destination Hub, a multi-venue cultural destination inviting visitors to explore the many stories of the city and its people through an immersive, multigallery experience;

- a gateway to the Mournes, redefining the visitor destination experience associated with the Mourne Mountains and coastline, including new adventure based attractions;

- the creation of a word class heritage attraction at Hillsborough Castle and Hillsborough Village;

- extension of the Gobbins to create a ‘must do’ adventure experience on the Antrim Coast;

- the Game of Thrones Legacy Attraction at Moneyglass will transform the Winterfell Castle filmset into a unique visitor experience;

- Whitespots Regional Park, opening up access to Strangford Lough and the Ards Peninsula;

- regeneration, repositioning and rebranding the town of Carrickfergus, placing the Castle and Walled Town firmly on the map as an authentic heritage-led tourism hub;

- Bangor Waterfront Regeneration of a two mile stretch of coast from Ballyholme Beach to Bangor Town Centre, Marina and Waterfront, creating a seaside destination of choice; and

- innovation led, phased regeneration of St Patrick’s Barracks in Ballymena.

As well as the Belfast Region City deal, opportunity has been identified through the recently announced UK Tourism Sector Deal. In what is the first of its kind, the UK’s Industrial Strategy has identified tourism as one of 10 sectors in need of particular focus through the sector deal.

While tourism is a devolved power within Northern Ireland, The British Tourist Authority has responsibility for marketing Britain worldwide and developing its visitor economy. The UK Government is liaising with the devolved nations on future work and identifying projects the devolved governments would like to partner in.

The sector deal is forward thinking and has a particular focus on five key areas, namely:

Ideas: Creation of a tourism data hub;

People: The creation of 10,000 apprenticeships by 2025, a £1 million recruitment and retention programme and increasing in-work training;

Infrastructure: Developing 130,000 bedrooms by 2025, and investment in attractions and innovations. Development of its Maritime and Aviation strategies;

Place: Piloting five new Tourism Zones to support the ambition to make the UK the most accessible tourism destination in Europe by 2025;

Business environment: A Business Events Action Plan 2019–25.

Challenges

Despite the potential offered by the two pieces of policy, the establishment of a tourism strategy for Northern Ireland remains a priority. Senior tourism stakeholders have warned of the perils of allowing the two deals to become Northern Ireland tourism’s capital plan for the next decade and not having direct guidance at local level on the future pathway.

The future pathway will be shaped by several factors. The most obvious is Brexit and the likely implications it will have on tourism growth. The uncertainty around Brexit has already been recognised as a key driver of sterling depreciation and it is argued that this depreciation is already having an impact on a shrinking domestic visitor market and hindering further growth of the GB market. In any Brexit outcome, the value of sterling is likely to fall, meaning this trend is set to continue. The Department for the Economy has also outlined a sharp fall in consumer spending in the event of a no deal Brexit and this would be further detrimental to the level of domestic and GB visitors to Northern Ireland.

On the other hand, sterling depreciation has been recognised as a main driver of growth from the Republic of Ireland market. However, any obstacles to travel or access will likely have a negative outcome for the tourism market.

Another major challenge for Northern Ireland is that of the dispersal of visitors in order for tourism’s impact to be felt across the region. Packaging the various Northern Ireland experiences to attract visitors to Northern Ireland to stay longer and spend more is a priority. However, without policy direction and financial support from central government, ensuring that Northern Ireland’s experiences are equipped to provide the services demanded by the modern customer is a challenge.

The absence of government is also a potential barrier to private investment. It’s widely believed that Northern Ireland needs at least one more major attraction on the level of the likes of Titanic Belfast or the Giant’s Causeway, as well development of experiences outside of Belfast, to capitalise on the wider economic benefits tourism can offer. However, large private investment is unlikely to be attracted without partnerships with the public sector and an initial government-led investment.

The need for greater dispersal of tourists across Northern Ireland is required for more than just economic reasons. There is wider recognition of the need for more sustainable tourism management given the increased burden that growing visitor numbers are putting on Northern Ireland’s largest attractions. At the same time, Belfast City Centre is expected to struggle to meet the projected visitor numbers going forward due to increased pressures on its already strained infrastructure, such as its road network and the waste and wastewater infrastructure.

Digital technology and data mining have been identified as key themes in not only enhancing visitor experience in Northern Ireland but also connecting visitors to those experiences. Greater utilisation of technology, while challenging, offers a solution to connect the tourism industry and provide economic benefits.

Greater dispersal of visitors across the region could help address the challenge of seasonality and the aim to ensure that Northern Ireland is attractive as a destination all year-long. However, such a move would also require an adequate workforce to service the industry. It’s estimated that by 2024 Northern Ireland will have 30,000 vacancies within the tourism industry. Any future tourism strategy must address the current skills gap and clearly establish measures to create an industry that is both attractive and rewarding as a career choice.