Food and drink

As the Brexit referendums threaten to distort positive predictions for the food and drink sector in 2015, agendaNi analyses the most recent statistics of the sector’s performance.

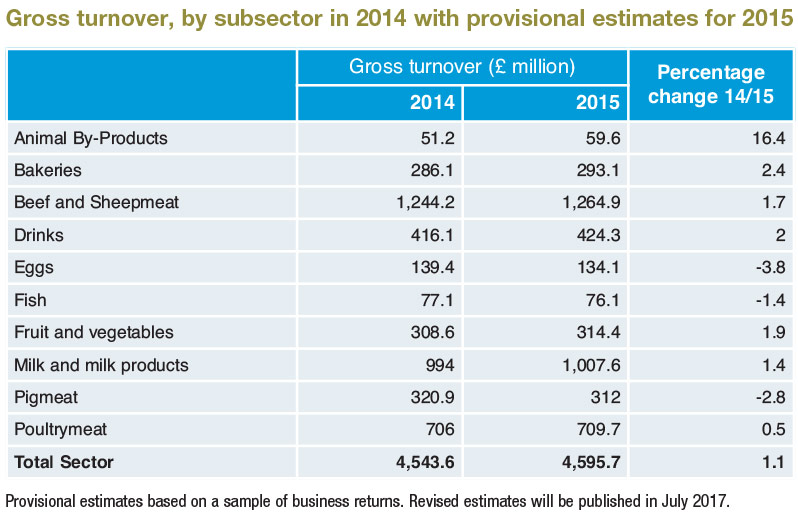

The food and drinks processing sector in Northern Ireland is estimated to have grown to £4,596 million in 2015, an increase of just over 1 per cent on the previous year and created an additional 290 full time employee jobs. The full data set on the performance of the sector for 2015 is not expected to be released until July 2017 but the Department of Agriculture, Environment and Rural Affairs (DAERA) have released provisional estimates of gross turnover and employment alongside statistics for 2014.

Making up 25 per cent of Northern Ireland’s total manufacturing sales in 2014, seven of the 10 food and drink subsectors have increased their gross turnover between 2014 and 2015, with beef and sheepmeat (£20.8 million) and milk and milk products (£13.6 million) subsectors recording the largest increases. Those three subsectors accounted for 64.8 per cent of Northern Ireland’s food and drink’s total gross turnover in 2015. The highest rate of growth (16.4 per cent) was recorded in the animal by-products subsector, the smallest subsector across food and drink. Three sectors, including pigmeat (£8.9 million), eggs (£5.4 million) and fish (£1 million) all experienced a decrease in turnover.

Despite an estimated rise of employment of 291 full-time employees in 2015, there were recorded decreases for bakeries, drinks, fish and pigmeat subsectors. Currently around 21,048 people are employed full-time in the overall sector, 60 per cent of whom work in the sheepmeat, poultrymeat and bakeries subsector.

Gross turnover rose by an estimated £66 million between 2013 to 2014 but represented a 0.4 per cent decrease when inflation was factored in. Milk and milk products was the only subsector to record a decrease, falling by £6.1 million. In 2014, 290 businesses had a turnover of £250,000, 65 had a turnover of more than £10 million and 22 businesses had an annual turnover in excess of £50 million.

Value added by the food and drink sector generated 3.7 per cent of the Northern Ireland economy total in 2014, representing no change since 2013 figures. The value added for 2014 was estimated to be £721 million, up 2.3 per cent since 2013. However, poultrymeat (£143.8 million), beef and sheepmeat (£134.2 million) and drinks (£110.9 million), which were the largest subsectors for value added, decreased by over 1 per cent since 2013.

In 2014 direct employment decreased by 85 full time employees, with five of the 10 subsectors recording losses. The poultrymeat subsector recorded the largest decrease in jobs, down 504 employees, significantly more than decreases in other subsectors. The food and drink processing sector accounted for 26 per cent of Northern Ireland’s total manufacturing employment, down 1 per cent since 2013.

Between 2013 and 2014 sales in the food and drinks processing sector to outside Northern Ireland increased by just £8 million to £3,299 but the percentage proportion of the same sales fell almost 1 per cent. Great Britain continues to be the sector’s largest outlet and sales to GB increased by 2 per cent from 2013 to 2014 to £2,010 million. Sales to markets outside of the UK decreased by 2.3 per cent over the year, however, the value of export sales remain higher than sales within the domestic market.

The largest export market (sales to outside the UK) remains the Republic of Ireland, which recorded a 1.9 per cent increase in sales to £708 million in 2014. RoI accounted for 15.6 per cent of the total food and drinks sector. The sector accounted for 21 per cent of Northern Ireland’s total manufacturing export sales, a decrease of 1 per cent from 2013.