Assessing the Executive’s 2025/26 Budget

The passage of the Budget Act (Northern Ireland) 2025 marks a critical moment for the region’s fiscal management, with the Executive aiming to strike a balance between immediate public service demands and financial sustainability.

The return of the Northern Ireland Executive in February 2024, following a prolonged period of political instability, created both opportunities and constraints in shaping the 2025/26 Budget.

The Executive’s ability to allocate funds has been shaped by several recent fiscal developments, including UK Treasury loans to cover previous overspending, a UK Government financial package accompanying the restoration of Stormont, and the broader economic pressures facing public services.

The Budget Act (Northern Ireland) 2025 authorises the use of £31 billion in resources for public services across the region, with £28.15 billion allocated for current expenditure and £2.89 billion for capital investment. The Act also enables borrowing on the credit of these sums, allowing the Department of Finance to manage cash flow efficiently while adhering to strict budgetary controls.

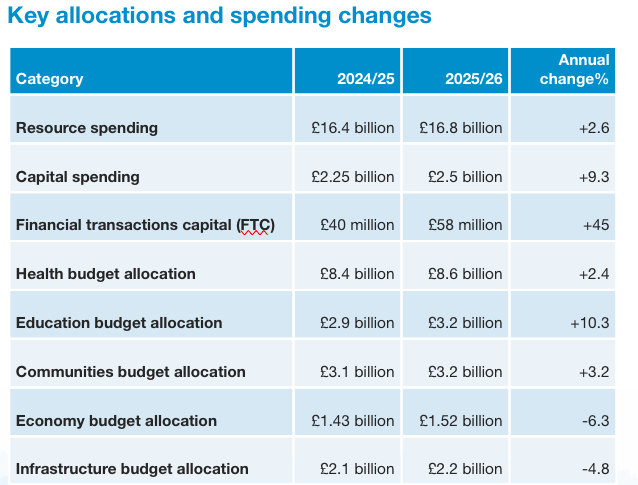

Key allocations and departmental challenges

The 2025/26 Budget outlines significant allocations to key departments:

• Health: As expected, health remains the largest component of the budget, receiving 51 per cent of total resource funding. However, despite its size, its uplift is lower than those of other key areas such as education and justice. A crucial assumption underpinning the budget is that Health Trusts will generate £200 million in additional savings – a reliance that carries risk given ongoing financial pressures in the health service.

• Education: This sector sees a substantial boost, reflecting commitments to reducing waiting lists and increasing elective care capacity. However, there remains a lack of specific funding commitments for long-term educational reforms.

• Infrastructure: With an increase of £74 million compared to 2024/25, the Infrastructure budget focuses on improving transport networks and essential public works, partially supplemented by a £87 million contribution from the Irish Government for the A5 road project.

• Justice: A considerable uplift in funding reflects pressures on policing, particularly regarding the costs associated with the PSNI data breach and ongoing security concerns.

Despite these increases, overall departmental allocations are constrained by the need to accommodate only £1.25 billion of the £4.2 billion in departmental bids.

The ‘cliff edge’ challenge

While the UK Government’s recent restoration package includes a 24 per cent top-up to Barnett consequentials, designed to address historical underfunding, the impact of short-term fiscal support tapering off in 2026/27 could create significant challenges. The Northern Ireland Fiscal Council warns that without further intervention, the Block Grant could see a real-term reduction, posing further risks to frontline services.

The UK Treasury has agreed to review the funding settlement in the next UK Spending Review, but uncertainties remain. However, the Fiscal Council outlines potential solutions to mitigate the cliff edge include:

1. a permanent uplift in the Block Grant to maintain public spending at least 24 per cent above equivalent English levels;

2. a multi-year funding commitment that extends beyond the immediate financial year, allowing departments to plan more effectively; and

3. short-term funding injections, similar to those used in previous political agreements.

Revenue raising and budget sustainability

The Executive has committed to raising £130 million in new revenue in 2025/26, with increases in Regional Rates contributing the largest share. However, structural revenue raising measures, such as water charges or significant reform of the rates system, remain politically contentious and have not been implemented.

Without additional sources of income, the Executive may have to consider unpopular decisions, including public sector pay restraint or further departmental savings, to maintain budgetary balance. The Fiscal Council notes that the Executive’s dependency on Treasury grants leaves it vulnerable to UK-wide policy changes, such as shifts in welfare spending or defence allocations that could indirectly impact Northern Ireland’s funding settlement.

Capital investment

Capital spending is set at £2.5 billion, representing a 9.3 per cent increase from the previous year. The largest allocations include:

• infrastructure (£933 million), focusing on roads, public transport, and energy projects;

• health (£391 million), though still below the department’s requested funding levels; and

• education (£270 million), supporting school infrastructure improvements.

Financial transactions capital (FTC), which funds loans to private-sector entities, stands at £58 million, but past underutilisation suggests challenges in deploying these funds effectively.

The need for structural reform

While the 2025/26 Budget offers stability in the short term, longer-term structural reforms are necessary to ensure fiscal sustainability. The potential introduction of domestic water charges, re-evaluation of public sector pay parity with England, and a shift towards multi-year budgets are all measures that could ease financial pressures, according to the Fiscal Council. However, political willingness to implement such reforms remains uncertain, and such measures would likely be met with significant opposition among the public.

Upon passage, then-Minister for the Economy Conor Murphy stated: “We have worked hard to deliver a balanced budget that reflects the needs of our citizens. However, we are under no illusions about the challenges ahead. Securing a sustainable funding model with Westminster will be crucial to maintaining public services and ensuring long-term financial stability.”

Secretary of State Hilary Benn MP says that the UK Government “recognises the pressures facing the Executive” and committed to “reviewing the funding settlement and ensuring that Northern Ireland receives the support it needs to deliver for its people”.

Robert Chote, chair of the Northern Ireland Fiscal Council, says: “We acknowledge the positive impact the UK Autumn Budget has had on the Executive’s draft budget for 2025/26 but most of the additional funding meets existing pressures rather than enabling new priorities, or public service transformation.

“The question of whether Northern Ireland will be funded at need in future remains an open one, but this should not distract the Executive from continuing to ensure Northern Ireland’s public finances are made more sustainable ”