Comparing income inequality on the island of Ireland

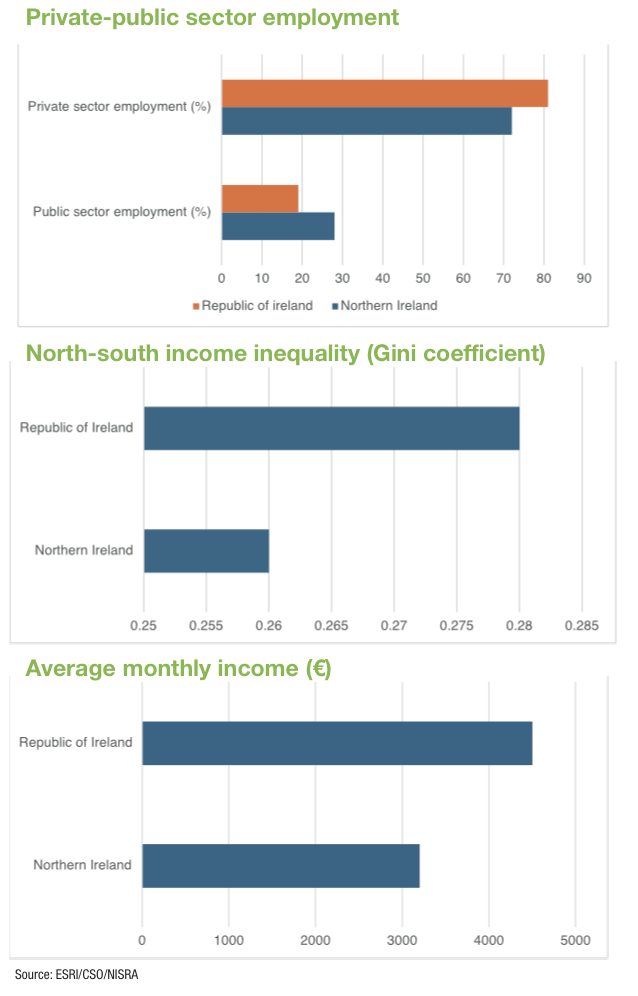

An overreliance on the public sector as a source of employment is contributing to a higher level of average wages in the Republic than in Northern Ireland, while income inequality is broadly similar in the two jurisdictions, research from the Economic and Social Research Institute (ESRI) has asserted.

Despite having similar Gini coefficients – the standard measure of income inequality – the ESRI study, published in October 2024, reveals deeper structural distinctions between the two jurisdictions. Income inequality in the Republic, with a Gini coefficient of 0.28 after taxes and transfers, is slightly higher than Northern Ireland’s at 0.26, yet “as seemingly similar income distributions can come about for different underlying reasons,” the ESRI analysis shows the significant role of divergent economic and social dynamics.

The Republic’s relatively high wage inequality reflects both the opportunities and challenges of a private sector-driven economy, while Northern Ireland’s flatter wage structure is shaped by a greater reliance on public-sector employment, which “provides a higher tax burden for very high income families” but also limits the region’s wage growth potential relative to the private sector in the Republic.

The labour force in the Republic of Ireland benefits from a younger and more highly educated population, with a strong supply of talent feeding into high-wage industries. A robust private sector – driven by multinational corporations, particularly in the technology and pharmaceutical sectors – has fuelled substantial economic growth. This structure has helped increase income levels, yet also brought greater wage disparity.

In contrast, the ESRI states that Northern Ireland’s workforce is “generally older and less educated,” with fewer high-wage opportunities in the private sector. Public-sector employment is more prominent, which, while stabilising wages, limits private-sector wage growth and economic mobility. The ESRI notes: “Just 23 per cent of adults in Northern Ireland have tertiary education, while the comparative figure for Ireland is 47 per cent,” underscoring the structural limitations Northern Ireland faces in creating access to high-wage employment opportunities.

Differences in education and labour market participation have particularly pronounced impacts on income inequality. In Ireland, the greater prevalence of tertiary education means that many adults can pursue high-paying jobs, reducing baseline inequality by enabling more people to move out of low-income brackets. Northern Ireland’s lower education levels, combined with higher rates of economic inactivity, restrict income-earning potential for a large segment of the population. The ESRI report suggests that improving workforce skills and educational access in Northern Ireland could be pivotal in bridging the income gap.

The report also explores how each region’s tax-benefit system shapes income distribution. The Republic’s tax system is more progressive, imposing a greater tax burden on top earners and effectively reducing income inequality. Meanwhile, Northern Ireland’s tax structure is comparatively lighter on high earners but compensates with a far-reaching means-tested benefits system, which the ESRI estimates “covers around 50 per cent of households, compared to 25 per cent in [the Republic of] Ireland”.

This broad social safety net cushions, the ESRI asserts, protects low-income households against poverty, but also underscores Northern Ireland’s lower average income base and greater reliance on income supports. While the Republic’s tax system reduces inequality at the top, Northern Ireland’s benefits structure plays a critical role for low-income families, helping to mitigate inequality within the region.

For policymakers in Northern Ireland, these findings highlight potential areas for strategic reform. A key takeaway is that increasing educational attainment and workforce skills could significantly impact income inequality, as a more skilled workforce would expand access to high-wage jobs, reduce dependency on low-income employment, and increase overall productivity. Supporting this focus on upskilling and education, the ESRI notes, would have benefits in the long term in “reducing polarisation in the distribution of earnings and reducing inequality in market income”.

Additionally, the paper argues that policies to stimulate the private sector, particularly high-value industries, could help diversify the wage structure in Northern Ireland. The promotion of sectors such as technology, renewable energy, and advanced manufacturing would not only enhance wage competitiveness but also reduce Northern Ireland’s dependency on public sector roles. Gradual adjustments toward a more progressive tax system could also increase redistribution from top earners, while expanded benefits could address income needs at the lower end of the income spectrum more effectively.

Cross-border policy coordination presents another area of potential benefit. Given the close economic ties and shared social interests between the regions, cooperative efforts in education, skills development, and strategic investment could strengthen labour mobility and economic resilience on both sides of the border.

For example, a coordinated approach to workforce development and sectoral investment could help bridge economic gaps while respecting the unique contexts of each jurisdiction. The ESRI’s findings suggest that as the island explores increased economic cooperation, “any convergence in the future between the tax-benefit systems… may have a limited impact on income inequality due to opposing forces in the tax and benefit system.” However, more broadly, such alignment could lead to mutual benefits, enhancing regional stability and fostering a more cohesive economic environment.

The ESRI’s report sheds light on how the structure of the two economies have – albeit in subtly different manners – driven income inequality across the island of Ireland. While the two regions have broadly similar levels of inequality, there is both a higher standard of living and significantly higher average earnings in the Republic, which correlates with the significantly relatively larger source of public sector employment in Northern Ireland.