Ireland tops Europe and Britain in high-value FDI attraction

The Northern Ireland Protocol has become an advantage in attracting foreign direct investment (FDI), a new report by the Economic and Social Research Institute (ESRI) has found, with high-value FDI now accounting for over 70 per cent of all new greenfield FDI projects on the island of Ireland.

In its report, Enhancing the attractiveness of the island of Ireland to high-value foreign direct investment, the ESRI found that “Northern Ireland’s continued access to the EU single market for goods secured through the Protocol is a key comparative advantage for attracting high-value FDI relative to the other regions in the UK”.

The findings of the report back up this assertion, with the FDI in high-value sectors in both the Republic of Ireland and Northern Ireland showing greater shares of all new greenfield FDI projects than Great Britain or the remaining 26 EU state outside of the Republic. The high-value sectors included in the ESRI’s analysis include: aerospace; biotechnology; pharmaceuticals; medical devices; semiconductors; business machines and equipment; electronic components; consumer electronics; communications; software and IT services; financial services; business servicers; and space and defence.

Greenfield FDI projects are defined as “new operations established by foreign companies at a new site”. These high-value projects account for 76 per cent of all new greenfield FDI project in the Republic of Ireland and 70 per cent in Northern Ireland, compared to 67 per cent in Britain and 51 per cent in the EU26. 70 per cent and 76 per cent of new greenfield FDI in the Republic and North respectively are accounted for by these high-value projects, compared to 39 per cent in Britain and 24 per cent in the EU26.

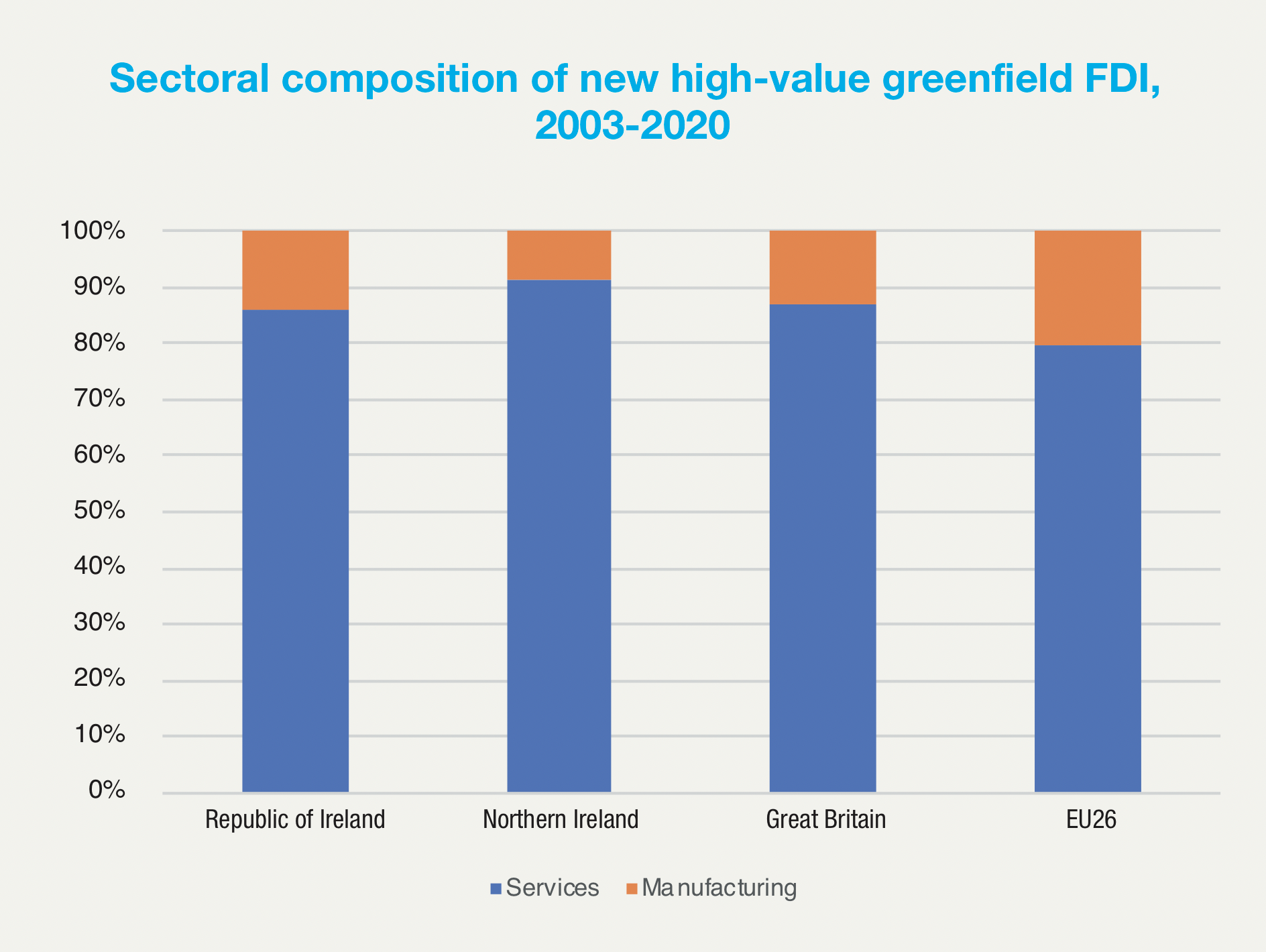

High-value FDI on both sides of the border in Ireland is dominated by services, which accounts for 86 per cent of all high-value FDI in the Republic and 91 per cent in Northern Ireland. Services account for 87 per cent and 80 per cent of the high-value FDI in Britain and the EU26 respectively.

Northern Ireland high-value FDI market is dominated by software and IT services, with these projects accounting for 53 per cent of new high-value greenfield FDI projects from 2003-2020; only two other sectors – business services (19.2 per cent) and communications (10.5 per cent) – account for more than 10 per cent of the market. Software and IT services is the dominant sector in all jurisdictions considered, although not to the extent of Northern Ireland. It accounts for 36.3 per cent, 42.4 per cent, and 32.1 per cent in the Republic of Ireland, Britain, and the EU26 respectively.

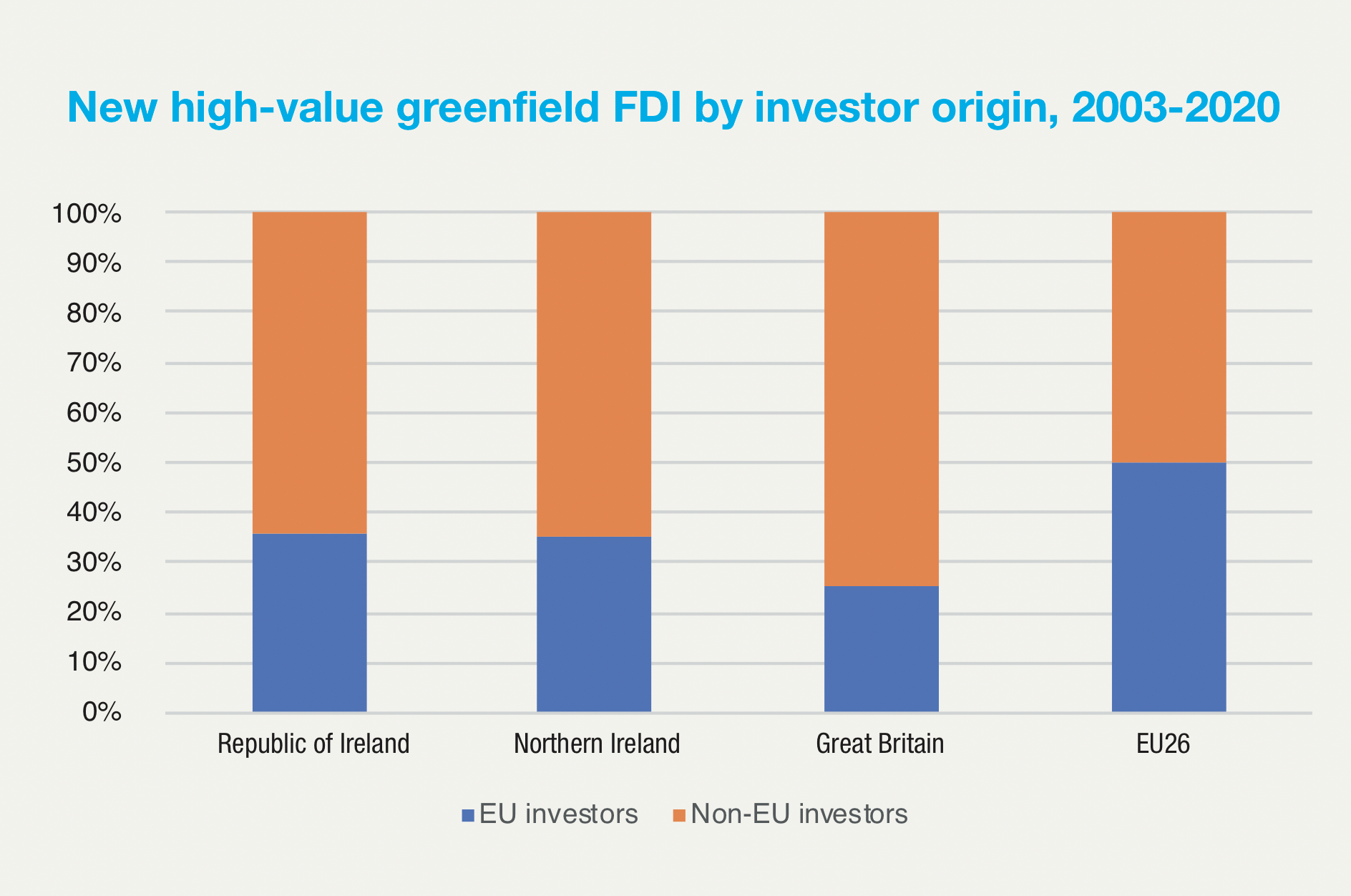

Consistent with the report’s assertion that Northern Ireland’s access to the EU’s market is giving it a comparative advantage to the rest of the UK in attracting high-value FDI are the report’s findings on the origin of high-value FDI investors from 2003-2020 in Ireland, Britain and Europe. While all markets received the majority of their high-value FDI from non-EU investors, Britain recorded a proportion of 74.4 per cent of investors from outside the EU, with Northern Ireland being next closest of the four markets with a rate of 64.8 per cent, more comparable to that of the Republic, 64.2 per cent. FDI into the EU26 was an almost perfect split, with 50.1 per cent of high-value FDI coming from outside the EU.

The research “indicate[s] that the attractiveness of a given location in the EU and UK is positively associated with EU market potential, domestic market growth, low labour costs, agglomeration economies in knowledge-intensive sectors, availability of skills, R&D expenditure in the public sector (government and higher education), government funding of business expenditure on R&D, broadband access, low corporate taxation, less restrictive regulations with respect to FDI and less complex business regulations”.

With these determining factors in mind, the report examines a range of possible scenarios for enhancing the attractiveness of the island of Ireland with regard to FDI. The ESRI’s research “finds that the largest gains in terms of the number of high-value FDI projects that would be attracted to both [the Republic of] Ireland and Northern Ireland would be in the case of higher R&D expenditure in the public sector”, and in the case of Northern Ireland, that attractiveness would also be increased by “a situation of increased educational attainment of the working-age population”.

Another suggestion within is the development of “complementarities between the two jurisdictions”, particularly in regard to EU market potential, workplace skills and investment in R&D in the public sector. To this extent, the report notes, already existing initiatives in Ireland such as the North-South Research Programme and the proposed all-island centres of research excellence are “likely to contribute to enhancing the attractiveness of both jurisdictions to high-value FDI”.

The report also estimates that plans for the Republic to move to a corporate tax rate of 15 per cent in line with global reform of corporate tax rates will result in the Republic suffering a decrease of 4.4 per cent per annum in high-value FDI, with Northern Ireland, where the rate is 19 per cent, experiencing a corresponding increase of 7.5 per cent per annum.

Policy choices that the ESRI suggest in order to compensate for the Republic’s decreased attractiveness upon the increase of the corporate tax rate include: increased R&D spend in the public sector; increased government funding of business R&D; and the incentivisation of higher proportions of the working-age population in participation in education and training and in the attainment of upper secondary and third-level education.