Energy and the economy

The number of energy sector enterprises in Northern Ireland has more than trebled in the last decade, representing the largest percentage increase of all UK regions, however, annual average turnover of the low carbon and renewable energy sector still remains well below that of its UK counterparts.

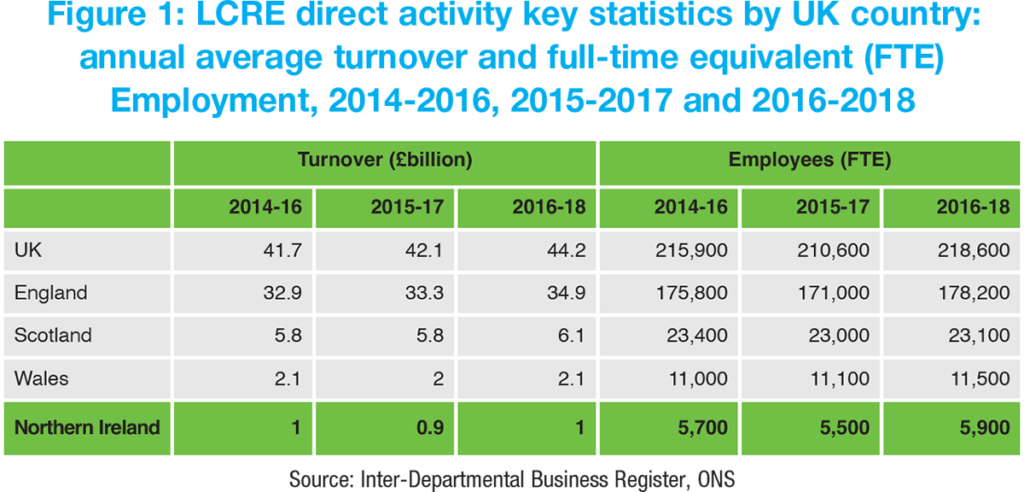

Between 2016 to 2018, low carbon and renewable energy activity generated an estimated £1 billion annual average turnover, representing little change from the average between 2014 to 2016. Northern Ireland contributed just 2 per cent of the UK’s combined turnover and 2.7 per cent of the UK’s direct full-time equivalent (FTE) employment in relation to low carbon and renewable energy.

Compared to England, Scotland and Wales, Northern Ireland’s annual turnover and number of employees for the sector was the lowest, around half of the same figures for Wales, the second lowest performer.

Associated with Northern Ireland’s estimated annual average turnover was 5,900 FTE jobs, compared to 11,500 in Wales, 23,100 in Scotland and 178,200 in England. Around half of these jobs in Northern Ireland related to the energy efficient production sub-group but this only made up around one third of annual turnover. By comparison, the low carbon electricity group also made up around one third of turnover but only an estimated 13 per cent of the average employees in the sector (see Figure 1).

Between 2016 to 2018, annual turnover was highest in the energy efficient products sub-group (£317 million). Coupled with low carbon electricity (£284 million), these two sub-groups were the largest contributor to overall turnover by some distance, with the next highest contributing sub-group being low carbon heat at just £51 million.

Interestingly, annual turnover did not directly correspond to FTE figures. Although energy efficient products, the highest sub-group for turnover, did generate the greatest number of employees (2,900), the next biggest employment sub-group was for low-emission vehicles (1,600), a group not accounted for in relation to turnover, given the small number of businesses operating in the sector (see Figure 4).

Energy sector

Figures produced by NISRA outline a three and a half-fold increase in energy sector enterprises from 2010 to 2017. This data is aggregated using the Standard Industrial Classification (SIC), which does not lend itself to measuring non-traditional or new sectors, such as the renewable energy sector and low carbon economy and included in the growth figures are, for example, electricity generation from fossil fuel-based plants. However, it should be recognised that as well as a growth in enterprises, some of those not classified as within the low carbon and renewable electricity sector, are working to diversify their operations against an overarching ambition of decarbonisation.

The SIC division of electricity, gas, steam, and air conditioning supply was the main driver of the increase in enterprises, rising from 35 in 2010 to 490 in 2019. Almost all (96 per cent) of enterprises in this sector related to electric power generation, transmission, and distribution, a fifteenfold increase from 2010, and is recognised as coinciding with the large growth of renewable electricity producers (see Figure 2).

Northern Ireland had the largest percentage increase in the number of energy sector enterprises from 2010 to 2019 (up 256 per cent), almost double the increases in England, Scotland, and Wales. In 2010, Northern Ireland had the lowest number of energy enterprises as a percentage of all enterprises (0.4 per cent), below the UK average of 0.6 per cent. However, by 2019 Northern Ireland had a higher number of energy sector enterprises as a percentage of all enterprises (1.1 per cent) than England and Wales (both 0.9 per cent) and was above the UK average (1 per cent) (see Figure 3).

Energy employment

In 2017, some 3,860 employee jobs existed in the energy sector in Northern Ireland, 0.5 per cent of all employee jobs. The majority of energy sector jobs are concentrated in the sub-sectors of electricity, gas, steam and air conditioning (47 per cent) and water collection, treatment and supply (32 per cent). In 2017, Northern Ireland had the lowest proportion of employee jobs in the energy sector compared to England, Scotland, and Wales. Wales had more than twice as many energy sector employees and Scotland had five times as much (see Figure 4).

The Department for the Economy estimates that the energy sector accounts for around 2 per cent of total GVA in each year from 2013 to 2018. GVA in relation to the sub-sector of electricity, gas, steam and air conditioning supply was between four to five times higher between 2014 and 2018 than the all sectors average. In 2018, the GVA per head for the sub-sector was 18 times higher than for the GVA per head average for the UK as a whole, compared to a GVA per head figure for all sectors being 19 per cent below the UK figure.