Uncertainty fuels downturn

Following a positive trend in the Northern Ireland property market, recent uncertainty within markets following the vote to Leave has led to a downturn for both residential and commercial subsectors.

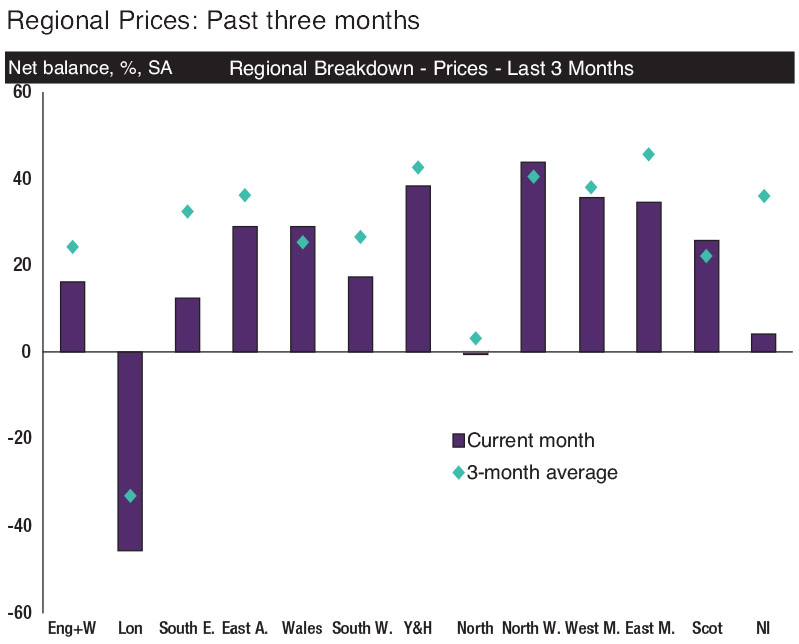

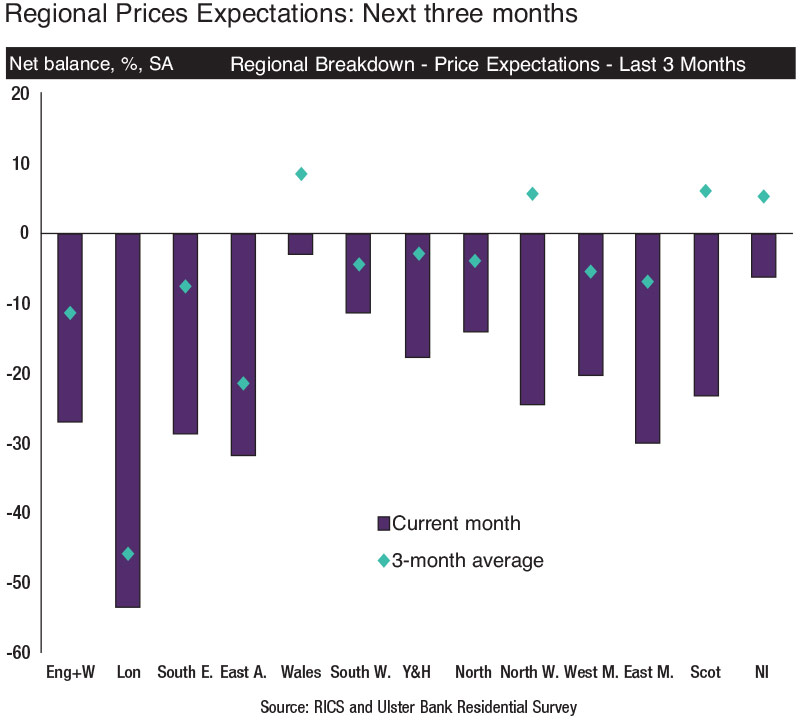

The overall price balance for residential property in Northern Ireland fell to its lowest level in over three years in June, highly influenced by the outcome of the Brexit referendum. By September it is predicted that the balance for price expectations will be negative for the first time since May 2013.

June’s figures for sales were up by 1 per cent on a sharp slowdown in May but are expected to be at their lowest since October 2012 come September. The RICS and Ulster Bank Residential Market Survey for Northern Ireland, June 2016, recorded the new buyer

enquires fell for a third month in a row, while there was minimal growth in new instructions to sell.

As well as the residential market, commercial property in Northern Ireland has also witnessed a downturn from both investors and occupiers. Post-referendum market uncertainty saw investment enquiries fall dramatically from a net balance of +36 per cent to -5 per cent, while foreign investment followed a similar trend from +24 per cent in the first quarter of 2016 to -15 percent in Q2. Capital value expectations are predicted to fall to -28 per cent by October.

Despite remaining positive, the occupier net balance eased to +5 per cent in Q2 from +36 per cent in Q1 and the office sector, the only sector to see a rise in demand, was heavily reduced in the second quarter. A decrease in demand also meant for weaker rental projections. Three per cent more of respondents to The RICS NI Commercial Market Survey are expecting rents to decline leading up to October, a contrast to the 26 per cent who predicted rents to increase at the start of the year.